- The Deep View

- Posts

- AI brings wealth building to non-millionaires

AI brings wealth building to non-millionaires

Welcome back. Traditional wealth management services are primarily accessed by investors with portfolios of over $1 million. However, in today’s newsletter, The Deep View's Jack Kubinec unpacks the world of AI-powered wealth management. Already, AI is allowing wealth managers to serve more clients while also democratizing financial expertise to empower retail investors — especially new investors in their 20s. But is that a good thing, and what does the future look like? Read on to find out. —Jason Hiner

1. AI brings wealth building to non-millionaires

2. Can you trust AI for financial advice?

3. For some young people, AI is the ‘daily driver’

MARKETS

AI brings wealth building to non-millionaires

The wealth management business is pretty simple: Help clients manage their finances in exchange for a fee, which is often based on the client’s assets under management.

The problem with this setup, according to Joe Percoco, co-founder of investment management startup Titan, is that it incentivizes wealth managers to take on only high-net-worth clients, leaving wealth management services out of reach for younger or less wealthy people (wealth management account minimums can run into the millions).

But AI can give wealth managers “super powers,” making it feasible to service more than just wealthy customers, Percoco said. AI can handle the client life cycle by collecting client information, understanding the client’s situation, considering solutions, and making recommendations. These efficiency gains could unlock the kind of broad access typically available only through brokerages, rather than registered investment advisors (RIAs).

“The tools of AI actually enable that to truly democratize for the first time ever, meaning a kid coming out of college can actually have the same quality of advice, capabilities, and price point of a Goldman Sachs private wealth manager,” Percoco said.

Still, Percoco doesn’t foresee the human being taken out of the equation.

“We're not too optimistic of people who just throw AI slop at, in theory, one of the highest trust use cases in all of consumer [business],” Percoco said. “We actually don't believe that's gonna work, nor do we think the capabilities are there for consumers to truly trust it.” The question, for Percoco, isn’t whether a human will be the one managing clients’ wealth. The question is how many clients can each human take on — 100 or 5,000?

Titan’s vision of modernized wealth management earned it the backing of the venture capital firm Andreessen Horowitz. And fellow VC giant Sequoia recently bet on another AI wealth management firm, Nevis. Vertical AI startups have taken off in the legal and medical worlds, and a race is shaping up in the personal finance vertical.

TOGETHER WITH NEBIUS

Nebius Token Factory — Post-training

Nebius Token Factory just launched Post-training — the missing layer for teams building production-grade AI on open-source models.

You can now fine-tune frontier models like DeepSeek V3, GPT-OSS 20B & 120B, and Qwen3 Coder across multi-node GPU clusters with stability up to 131k context. Models become deeply adapted to your domain, your tone, your structure, your workflows.

Deployment is one click: dedicated endpoints, SLAs, and zero-retention privacy. And for launch, fine-tuning GPT-OSS 20B & 120B (Full FT + LoRA FT) is free until Jan 9. This is the shift from generic base models to custom production engines.

MARKETS

Can you trust AI for financial advice?

As AI becomes increasingly integrated into consumers’ lives, more people are turning to AI tools for financial information or advice.

An Intuit Credit Karma survey showed 66% of generative AI users used chatbots for financial advice, and the figure rose above 80% for millennial and Gen-Z users. But while people are asking AI about their finances, they don’t always trust what they hear. In the Intuit Survey, 80% of respondents said they did additional research before acting on AI’s advice. And a Northwestern Mutual survey found that people trusted people more than AI to perform a variety of financial planning and budget management tasks.

Jake Eaton, senior partnership manager at Circle, said he views AI as powerful for his personal finances, but only in a few ways. AI can formalize his thoughts and financial goals, but Eaton said he wouldn’t want the AI to act on the information. He would also use AI to implement an automated trading strategy he wouldn’t want to do himself, offering an automated Polymarket strategy as an example.

Finally, Eaton said, he would accept AI advising and automated trading if performed under the auspices of a reputable company like Robinhood. Notably, many investment platforms already perform versions of this, where robo-advisers factor in user risk appetites and financial goals to automatically rebalance portfolios.

So while AI has become a financial tool, particularly for young people, people still seem hesitant to take humans out of the driver’s seat. As Titan co-founder Joe Percoco pointed out, finance is arguably the highest-trust sector in the consumer economy, so the bar is high.

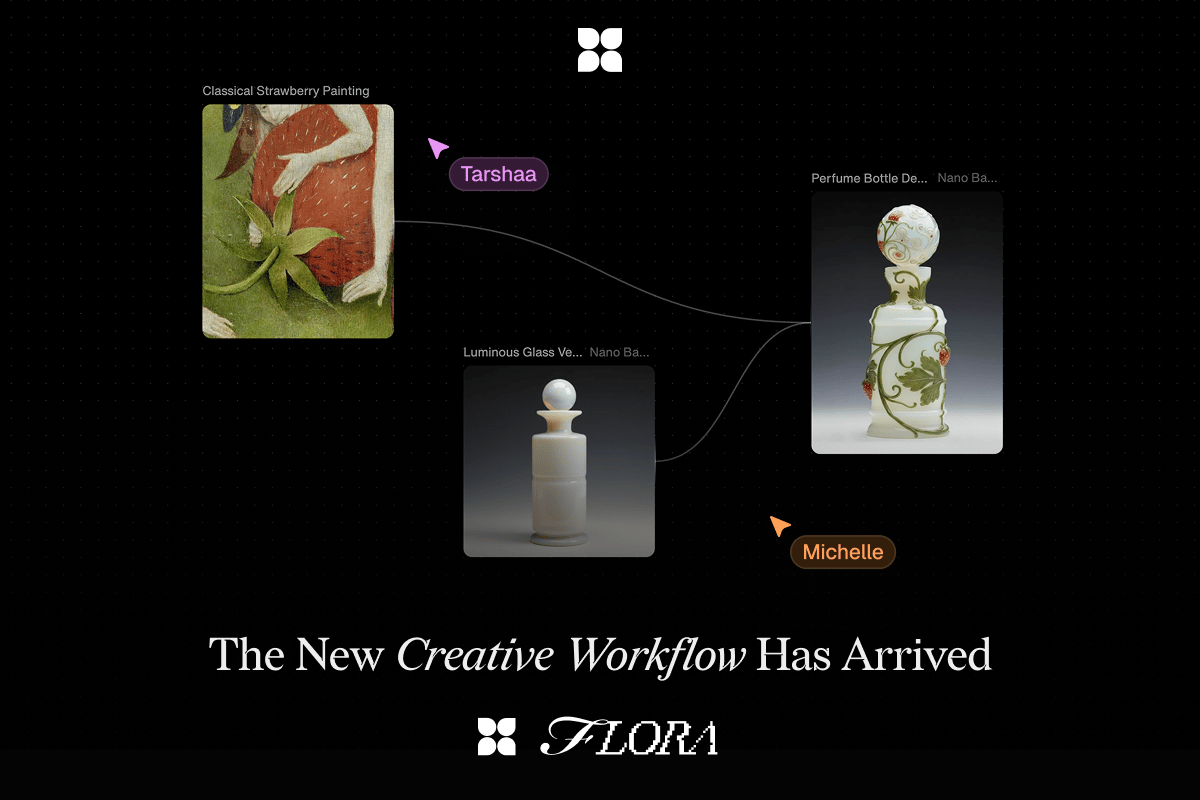

TOGETHER WITH FLORA

The First 50 People To Click This Get 50% Off

You better hope you opened your email early today, because this offer is too good to pass up – FLORA is giving the first 50 people to use code “deepview” at checkout 50% off the first month of their Agency Standard Tier subscription.

What do you get with the subscription? Oh, just complete access to best-in-class creative tools that immediately put the power of AI in your hands. With FLORA, you can generate, iterate, and design like a pro, regardless of your creative chops – meaning you can bring even your craziest ideas to life with just a few clicks.

MARKETS

For some young people, AI is the ‘daily driver’

For young people using AI to think through their finances, retail trading is increasingly likely to come up in conversation.

Retail investing flows grew by 50% between 2023 and 2025, according to JPMorgan data, and investment platform adoption has seen a sharp uptick among people in their twenties. Increasingly, these young investors form their trading strategies with the help of chatbots.

“We're seeing people using Surf as their daily driver for investment advice for how they want to find opportunities in crypto markets,” Ryan Li, co-founder and CEO of AI crypto trading platform Surf, said. He added that Surf uses custom models in which the data input is curated, so the AI produces higher-quality outputs for users — and, in theory, hallucinates less.

If Harvey and Open Evidence can be valued in the billions for domain-specific AI businesses, then a similar business could be sold to traders, Li said. He also argued that Surf’s AI model can surface insights and strategies that users couldn’t otherwise find.

And if AI trading companions are going to have legs, fine-tuned vertical startups may be needed, because whether it’s trading or running a vending machine, frontier models aren’t always the best with money.

It seems clear that as Zoomers and Millennials age, AI’s importance to their personal finances will only grow. If Percoco’s thesis is correct, AI will help democratize financial services and basic financial literacy. That’s assuming, of course, that the onset of highly advanced AI doesn’t condemn most young people to the permanent underclass.

LINKS

Meta acquires Chinese AI startup Manus for undisclosed sum

Google has released its Year in Search trends for 2025

The AI debate over jobs and data centers is heating up in the US

Geoffrey Hinton predicts AI will replace a lot more jobs in 2026

Andrew Ng shines the spotlight on AI’s limitations

Lou Gerstner, former IBM CEO credited for it’s turnaround, dies at 83

Nvidia has taken a $5 billion stake in Intel as part of September agreement

AbleMouse AI edition: An open-source tool for computer vision-powered mouse control.

Lighthouz AI: A billing automation platform for freight brokers.

/agent by Firecrawl: An API that navigates, and gathers data from complex websites.

Microsoft: Partner AI Architect - Generative AI & AI Agents

IBM: AI Architect

Mistral: Lead Software Engineer

Meta: Software Engineer, Infrastructure

POLL RESULTS

Do you expect to have an agent doing work for you in 2026?

Yes, I'm already using AI agents(33%)

Yes, I can't wait to start using AI agents (30%)

No, I'll believe AI agents when I see them (20%)

Other (17%)

The Deep View is written by Nat Rubio-Licht, Jason Hiner, Faris Kojok and The Deep View crew. Please reply with any feedback.

Thanks for reading today’s edition of The Deep View! We’ll see you in the next one.

“Less artifacts, more realistic to my eyes.” |

“The similarity in height and shape of the buildings and street lights in the background looked weird. And way too clean to be any real place on earth.” |

Take The Deep View with you on the go! We’ve got exclusive, in-depth interviews for you on The Deep View: Conversations podcast every Tuesday morning.

If you want to get in front of an audience of 450,000+ developers, business leaders and tech enthusiasts, get in touch with us here.